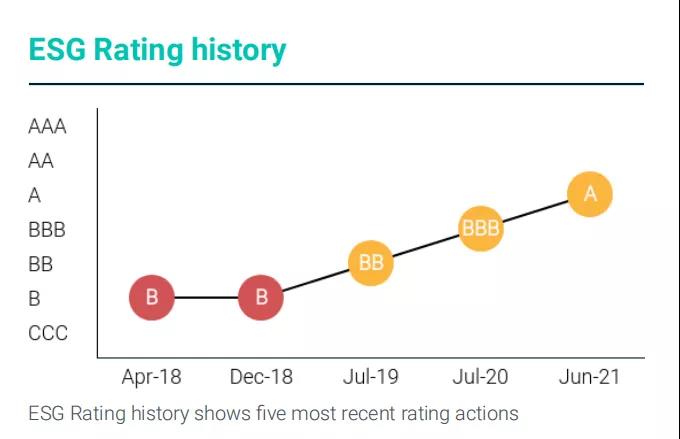

GPHL's listed arm Baiyunshan upgraded to Grade A in the MSCI ESG Ratings

2021-10-25 09:55:44 GPHL GPHL

Recently, Guangzhou Baiyunshan Pharmaceutical Co., Ltd. (Baiyunshan for short), a listed subsidiary of Guangzhou Pharmaceutical Holdings Limited (GPHL) was ranked A for its ESG (Environment, Social and Governance) performance, according to the latest ESG ratings released by Morgan Stanley Capital International (MSCI), a leading index company in the world. Since being officially included in the MSCI index system as one of the first A-share listed companies in June 2018, Baiyunshan's rating was upgraded again in June 2021.

As of June 24, 2021, among the global pharmaceutical peer companies rated by MSCI, about 20% received an A rating, 66% were rated below A, and 14% above A, which means Baiyunshan's ESG rating lies in the middle-to-upper range compared with its peers.

According to the latest MSCI rating results, Baiyunshan received more scores in issues such as “Toxic Emissions & Waste”, “Product Safety & Quality” “Human Capital Development” and “Access to Health Care”. Among those issues, the score of “Toxic Emissions & Waste” saw the most prominent upgrade, which shows that compared with its peer companies, it has taken more robust measures to address the environmental impacts of air, water and waste emissions than its competitors.

Since 2008, Baiyunshan has started to compile social responsibility reports and unveils them together with the corporate annual report every year. In 2016, in order to conform to the Hong Kong Stock Exchange ESG Guidelines, the company introduced various key index data in the original social responsibility report and integrated the ESG report to form a more comprehensive social responsibility statement. Up to 2021, Baiyunshan has issued 13 social responsibility reports for consecutive years.

About MSCI ESG:

MSCI is a leading provider of critical decision support tools and services for the global investment community. It conducts ESG ratings for over 2,800 companies every year, with the result serving as an important basis for global leading asset management organizations to make investment decisions. MSCI ESG Rating is designed to measure a company's resilience to long-term, industry material environmental, social and governance risks across 35 ESG Key Issues.

Authors: Monica & Nancy (intern)

Editors: Olivia & Jerry